|

Dear Colleague:

Provisioning and inventory systems used to be backstage,

batch-oriented, single-purpose systems designed to made life

easier for "swivel-chair" engineers who made manual network

changes.

Now, however, as telecoms face the daunting tasks of

configuring smartphones and triple play video services,

provisioning and inventory systems are increasing "going

live" and becoming far more real-time, integrated,

multi-layered, and mechanized.

Here are some product trends and achievements that are

changing the OSS fulfillment landscape:

- Inventory systems are moving closer to the

network. Subex Azure's solution, for instance, is

breaking new ground for

AT&T's triple play, offering daily service discovery

and tight integration between inventory and provisioning

to support "on-the-fly" customer self-service ordering.

- Wireless service bundles have become so complex that

synchronizing billing and provisioning requires great

technical dexterity. Comptel is addressing the problem

with a new central product catalog that

interfaces with the CRM and configures network elements

and content servers.

- Traditionally, as new networks are deployed,

telecoms migrate their OSS systems to a new platform.

Now, rules-based provisioning from Fastwire

abstracts generic design rules and allows

Optus in Australia

to preserve its OSS investments and enable targeted

network deployment to specific regions and customer

bases.

- Automated over-the-air handset provisioning

will soon enable 2.5G handsets to sport email, calendar,

and other Blackberry-like features. Here, Synchronica is

lightening the provisioning load for operators by

providing server side tools to allow real-time

interaction with phone users.

- Traditional network management systems lack a

precise view of IP devices underneath making it risky to

automate network grooming. Now Canadian operator

Telus is using an

Intelliden system to detect potential IPTV network

outages and launch mechanized and policy-based

reconfiguration that reduces the high expense and

errors of manual provisioning.

- When it comes to large-scale VoIP provisioning, the

OSS/BSS and network systems are often not fast enough to

deliver the instantaneous response needed to support a

self-care portal. To gain real-time performance,

Comcast uses a

Jacobs Rimell solution that maintains a persistent,

virtual provisioning layer that normalizes,

federates, and synchronizes operational data.

On the strength of these innovations, TRI pegs the market for provisioning and inventory

software market at $1.3 billion in 2006 and forecasts it to

grow to $1.8 billion in 2011.

Telecoms' urgent need for these efficiency and service-enabling

solutions presents great opportunities for companies and

internal IT shops who supply fulfillment software and related

services.

And that's precisely why your team needs to get a copy of

TRI's latest research study on the fulfillment

market: Telecom

Provisioning, Network Inventory, Activation & Service Management

Solutions.

This Report analyzes this complex market and shows how you and your

company can capitalize on the niches and avoid dangerous

forays into markets that are either too competitive or too

specialized to attract enough paying customers.

Whether you're a carrier executive aiming to improve your

OSS infrastructure or a vendor delivering inventory,

provisioning, or service management and related solutions, the Report will help you discover:

- What are the most important market

priorities?. . .

- Which success strategies

of other operators can you adopt at your own

telecom organization?

- Which vendors have industry

market share and are leading in specific niches?. . .

- What's the impact of large players such as

Oracle and Amdocs

entering the market?

- Which OSS players should you partner

with?. . .

- What emerging trends

can

your company capitalize on?. . .

Please scan the executive summary and full table of

contents below. You'll see why this report delivers the

tactical and strategic information you need to fully

understand where telecom provisioning and inventory systems

are headed.

To access this market intelligence today, contact

Wyatt Greenwalt at

TRI's

offices at 301-652-8350.

Sincerely,

Dan Baker

Research Director, TRI OSS/BSS KnowledgeBase

P.S. This Report is one research module in TRI's on-going OSS/BSS

KnowledgeBase covering the breadth of telecom

software and OSS innovations on a yearly basis.

Table

of Contents

Telecom

Provisioning,

Inventory, Activation &

Service Management Solutions

A. Executive Summary (2 pages)

B. Network Inventory (10 pages)

1. The Emergence of Capacity Inventory

2. Capacity Inventory -- Its Chief Characteristics

3. The Elegance of Inventory Federation

4. Bringing Just-in-Time Inventory to Play

5. Why itís Hard to Maintain Inventory in Modern Networks

6. How Poor Inventory Affects Provisioning

7. Provisioning Benefits of Accurate Inventory

8. Service Assurance Benefits of Accurate Inventory

9. Inventory's Value Beyond Provisioning

10. Telcordiaís Approach to Federation

C. IP Service Provisioning (5 pages)

1. Marrying IP Connectivity and IP Service Delivery

2. Cable Operator Comcast's Consolidated IP Platform

3. The Importance of Subscriber Management Systems

4. Why Enterprises are Looking to IP-VPNs

5. Provisioning Software for IP-VPNs

6. The Rise of Ethernet Competition to IP-VPNs

7. Metro Ethernet Yipes Rises Again as a National Ethernet

Provider

D. Rules Based Provisioning (4 pages)

1. Do New Network Deployments Require a New OSS?

2. How Rules-Based Differs from the Current Provisioning

Model

3. Consulting the Provisioning Design Playbook

4. Fastwire's Rules-Driven Design Abstraction

5. A Way to Strategically Insert New Network Technology

E. Terminal Provisioning (4 pages)

1. Market Drivers: Handsets, Protocols, Services, &

Automation

2. How Terminals are Provisioned

3. Complications in Terminal Provisioning

4. Two-Way Communication with the Handset

5. Device Management: Enabling a Mobile Email Explosion?

F. Access Network Provisioning (4 pages)

1. That Precious Telecom Asset -- Facilities in the Last

Mile

2. Why Access Network Automation is Vital to Next Generation

Services

3. The Benefits of Outside Plant Integration

4. Access Network Provisioning Benefits to Customer Care

G. Product Catalog (2 pages)

1. The Disconnect Between BSS and Provisioning Layers

2. Manufacturing Style Production

3. Market Demand for Product Catalogs

H. Carrier Interconnect Ordering (2

pages)

1. Interconnect: From Legal Battles to Business as Usual

2. Cable Providers Boost the Intercarrier Ordering Game

I. Network Planning, Design & Engineering

(2 pages)

1. The Coming Merger of Engineering and Provisioning Worlds

2. The Information & Culture Gap

3. The Role of Network Planning Software

J. Service Design and Order Management (11

pages)

1. Maintaining Eight Million Customers with a Manual

Ordering System

2. The Customer & Network-Facing Sides of Telecom Service

Orders

3. Network Orders and Billing Bundles

4. Why Cross-Industry Ordering Solutions Donít Fit Telecom

5. The Economics of Order Process Change

6. The Requirement for Advanced Order Management

7. Features of an Advanced Order Management System:

Expeditor

8. The Complexity of Network Order Management

9. Setting Priorities for Inventory/Provisioning Systems

10. Steps in the Provisioning a Service for an Enterprise

Customer

11. Not Being Captive to Genius Designers

12. Product Management Design vs. Implemented Design

12. Handling Manual Work Instructions

13. Designs Using the Provisioning "Lego" Model

14. Automation - Real-Time Quotes & Customer Responsiveness

15. Designing in Network Diversity

16. Limitations to Design Automation

17. How Business Policy Affects Fulfillment

17. Human Intervention in Provisioning

K. Provisioning History & Migration To NGN

(3 pages)

1. Provisioning Simplicity in the Circuit Voice World

2. Next Gen Networks: Multi-Vendor and Multi-Technology

Complexity

3. Uniting the Data and Network Layers

4. The Dynamic Nature of NGN Networks

L. Provisioning Mechanization &

Flow-Through (2 pages)

1. The Human Engineer in the OSS Loop

2. The Challenge of Flow Through Provisioning

M. Transport Network Provisioning (3

pages)

1. The History of the Merchant Provisioning/Inventory Market

2. The Purpose of a Transport Provisioning System

3. The Many OSS Systems Transport Provisioning Touches

4. Adding Business Rules during Service Creation

N. Service Management Systems (4 pages)

1. From Vertical Silos to a Horizontal Service Management

System

2. Service Management Components

3. Managing Component Dependencies

4. The Product Conception to Deployment Advantage

5. Instantiating the Service for the Customer

6. Service Management Initiative at Orange/France Telecom

O. Service Activation in Wireline

Networks (2 pages)

1. Basic Function of Wireline Network Activation

2. Shortening the Provisioning-to-Activation Process

P. Telecom Network Discovery (6 pages)

1. Telecom Network Discovery: Elements, Topology, Services

2. Why Telecom Discovery is Bound to Become More Important

3. The Value of Real-Time Inventory Reconciliation

4. Major Steps in the Telecom Discovery Process

5. The Auto Discovery & Upload Process

7. Discovery Across Telecom Equipment Clouds

8. Associating Network Assets with Services

9. Recovering Stranded Assets

10. Asset Reclamation -- Reconciling with Billing

11. Layer 1 Service Discovery

Q. Control Planes & Intelligent Agent

Discovery (2 pages)

1. Distributed vs. Centralized Network Management

2. How the Control Plane Discovers Topology

3. Example of Agent Peer-to-Peer Communication

R. Service Delivery Platform (2 pages)

1. SDP -- Defining a New Product Category 73

2. Telcordia's Multi-Purpose SDP Platform 74

3. SDPs & Large Telecoms 74

S. Content Management Systems (2 pages)

1. Definition and Functions

2. Content Acquisition & Bundling

3. Why Content Management Gives Carriers Better Control

T. IP Multimedia Subsystem (IMS) & the

OSS (2 pages)

1. Managing Multimedia Applications in an IP Services World

2. Instant Messenger IMS Implementation at SK Telecom

3. IMS Analysis and Alternative Solutions

U. Market Threats & Recommendations (3

Pages)

X. Market Segmentation & Forecast Analysis

(6 pages)

1. How TRI Develops its Market Segmentations

2. Market Growth Forecast

3. OEM vs. Service Provider

4. Distribution Channels

5. Geographic Region

6. Service Provider Type

7. Service Provider Size

8. Type of Provisioning & Inventory Solution

9. Networks/Devices Provisioned & Inventoried

Y. Case Studies (30 pages)

1. SingTel Optus: Rules-Based Provisioning & Inventory

2. Verizon's FIOS Provisioning & National Desktop

3. Verizon Wireless Content Management System

4. CenturyTelís Access-to-Transport DSL Provisioning System

4. Telecom Italia Sparkleís International Network Inventory

5. XO Communications Inventory & Provisioning System

Z. Provisioning & Inventory Definitions (4

pages)

Case

Studies

SingTel Optus Rules Based Provisioning & Inventory System

SingTel Optus is Australiaís second largest telecom offering

a full suite of residential, wholesale and business services

including Internet access, VPNs, Ethernet, mobile, voice and

data. Since 2001, the company has been owned by SingTel, one

of the largest communications service providers in Asia

Pacific. The company serves 4 million Australian homes

and revenues reached $6.7 billion in its 2007 fiscal year.

To win market share from the incumbent operator, Telstra,

Optus had to significantly reduce the time required to turn

up services for new and existing customers. The company

decided to achieve this goal by fully automating its

provisioning process for its highest volume business

communications services.

Automating the design and assign process has resulted in a

deduction in service design times from hours to minutes for

complex services. It further enables for example ďbatchingĒ

of similar orders. The net effect is that the complete

service order provisioning cycle has been reduced by up to

two days per service.

Verizon's FIOS Provisioning & National Desktop

The complexity of Verizon's current provisioning environment

has made it extremely difficult to support COTS

implementation.

The case explains the complexity of Verizon's OSS/BSS

environment and why the decision was made to develop

Verizon's next generation broadband FiOS environment

in-house.

FiOS is a true triple play service because voice data and

video are converged on a single pipe.

The study explains how the system's unique architecture that

separates the complexities of fiber from the transactions

pushed into Verizon's regular provisioning flow.

Another complication was to create a national system for

provisioning to handle workflows across the company's East

and West systems.'

CenturyTel's Access-to-Transport Provisioning System

CenturyTel

wanted a fully integrated and automated solution to speed up

the process and eliminate the errors that occur in assigning

DSLAM-to-ISP facilities manually.

The case shows how CenturyTel migrated its entire access

and network provisioning into an integrated

access-to-transport provisioning, managing over 4,000

devices and 200,000 customers. (9 pages including 4

figures)

Telecom Italia Sparkle's International

Network Inventory

Providing complex, customized services for

many of its large customers was proving costly for Telecom

Italia's international network unit, Sparkle.

The case shows how Telecom Italia Sparkle

delivered a single point of management for all services

configuration and activation across its retail and wholesale

operations, integrated with CRM, and unified legacy systems.

(6 pages including 2 figures)

Verizon Wireless Content Management

System

Verizon

Wireless recognized the revenue opportunities

afforded by IP content, but was looking for a solution that

would manage the many aspects of content management from a

central platform.

The case reveals the goals, challenges, and

benefit Verizon realized from implementing an electronic

content supply chain with revenue sharing controls, partner

settlements, subscriber profiling, and user device tracking.

(4 pages including 1 figure)

XO Communications Inventory &

Provisioning System

Consolidation was a pressing need for XO

Communications because -- from an ordering

perspective -- XO had two separate networks, its own and the

Allegiance network it had recently acquired.

The case study shows combined two inventory systems and

built integrations to mechanize provisioning operations to

lower costs, reduce the order-to-bill interval, and

eliminate manual provisioning errors.

Vendor

Profiles

Over twenty-two vendors have established themselves on the

telecommunications provisioning and inventory scene in recent years.

In this section, TRI analyzes each of the leading companies

in 2 to 5 page profiles delivering:

- Historical expertise and background

- Specific areas of strength and weaknesses

- Significant customers and partnerships

- Key products

- Differentiators that make the company standout

- The company's provisioning/inventory revenue for 2006

These vendor profiles and technical specs are a great

time-saver: they deliver the kind of information you'd

otherwise have to spend weeks tracking down. A list of

vendors profiled follows:

Market

Segments & Forecasts

TRI sizes and forecasts the worldwide market for

provisioning, inventory and service management software and

services. Our forecast model is based on several parameters:

TRI's historical

tracking of the OSS market; TRIís forecast of Next Generation Network

(NGN) services growth; discussions with carrier experts; and interviews with software and

consulting vendors.

The report provides 2006 base revenue and 2007 to 2011

forecast data for the global market in the following segments:

1. OEM vs. Service Provider Market

2. Distribution Channel

- Direct vs. Indirect Channels

3. Geographic Region

- North America, EMEA, Asia Pacific, Latin

America

4. Service Provider Type

- Wireline Voice, Broadband, Wireless,

Cable, Reseller, Other

5. Service Provider Size

- Tier 1, 2, and 3

6. Functional Category of Provisioning/Inventory

- Transport Network Provisioning

- Access Network Provisioning

- Network Inventory

- Service Activation & Discovery

- Order Management

- Content Management

- Service Management & IP Services Provisioning

- Intercarrier Order Gateway

- Wireless Provisioning

- Other

7. Type of Network/Device Provisioned or Inventoried

- Radio Access Networks|

- ATM/Frame Networks

- Broadband Networks

- Transmission Networks

- Fixed or Mobile Core TDM & Mobile HLR

- IP & Corporate Networks

- Service Delivery & IN Machinery

- Mobile, CPE & Home Terminals

- Other Networks/Devices

About

TRIís

B/OSS Market Research Reports

TRIís B/OSS market research studies are designed to help telecoms and OSS/BSS vendors track

market innovation in the sector.

Each of our reports delivers a fully

organized body of knowledge and analysis across three

interfaces:

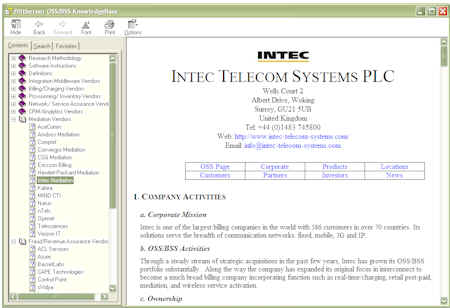

- Complete Microsoft

Word text of Report and Vendor Profiles.

Forecasts are delivered in MS Excel;

- A Compiled HTML file

for your desktop

PC that allows searching the text and

visuals of our analysis modules, case studies, and

vendor profiles; and,

- A Software Application

(written in Microsoft Visual Foxpro) with market

segmentation and forecast data that you use to view

customized data tables, graphs, vendor comparisons, and

print documents. Note: all data and forecast

tables are also provided in Microsoft Excel and

comma delimited files can be created too.

Below are some sample screens:

Compare

vendor market strength in grids. . .

View,

modify, and print our estimates of company financials. . .

View

market share graphs in international currencies. . .

Compare company financials. . .

Perform

fast text searches on the desktop. . .

Technology Research Institute

4-25 Rocky Mountain North

Effort of the Poconos, PA 18330

Tel: 570-620-2320

dbaker at technology-research.com

|