|

Dear Colleague:

Several years ago, Silicon Valley pundits

predicted that value-added IP-based services would soon

enable internet and media giants like Microsoft, Yahoo,

Disney, Viacom, Google to capture the lion’s

share of telecom industry revenues.

Telecoms -- so the story goes – were “dumb pipe

providers” and didn’t have the knowledge or clout to

succeed with value-added services. They would have

no choice but to lease their pipes at bargain-basement

prices and see the value of their network investments

dramatically decline.

So far, the dumb pipe theory hasn’t proven true.

In recent years

many telecoms have grown handsomely while the internet

and media giants have made only limited penetration. In

emerging countries like Russia, China, and India, telecoms

are among the fastest growing companies in their countries.

Perhaps the greatest dumb pipe success story of all is

Carlos

Slim, the man who controls Mexico’s Telmex and América

Móvil, and whose telecom investments are now worth $60

billion, making him the second richest man in the world --

surpassing even Bill Gates.

But how, you ask, could this happen? How could the dumb

pipe providers succeed while the technologically savvy

internet and media titans faltered?

I’ll tell you. Carlos Slim and the other telecom tycoons

knew something that their opponents didn’t. To extract

value from network investments, you don’t need a lot

of cutting-edge IP-services, location based services, or

advertising-enabled handsets.

You basically need to be expert in one value-added

service that’s worth all the rest. . . Billing.

Billing not only assures service revenue, it’s the

enabler of conversations with the customer.

In today’s telecom market, billing expertise usually spells

the difference between telecom operators who are gaining

market share and those falling behind. And it encompasses

a wide range of systems from pre-paid IN charging and

real-time convergent charging. . . to postpaid billing and

billing for interconnect and content partners.

While the revenue assurance role of billing is critical,

in recent years, it’s the merchandising and marketing role

of billing that’s delivering the greatest value. In the

wireless market, for example, billing software is

increasingly enabling services such as real-time advise of

charge, lifestyle packages, content charging, and marketing

promotions.

But what billing capabilities are vital to your company’s

future growth? And which billing vendors should your company

rely on to provide that all-important marketing and

accounting dialogue with customers?

To get answers to those questions is the purpose of

TRI’s report, The

Telecom Billing and Charging Market. This 289-page

report pinpoints what billing capabilities look most

fruitful and which vendor players are making a difference.

The study is really two reports in one: a thorough qualitative analysis of billing market

trends combined with an informed quantitative

estimate of market size, vendor revenue breakouts, market

share, and forecasts delivered in software you can

manipulate as you choose to create charts, tables, and Excel

reports.

In addition to its detailed, 8- to 13-page analyses of

major billing companies, the report tackles several of the

billing market’s most pressing issues, including:

- Wireless Merchandising and

Marketing. The wireless market is witnessing

a bewildering array of new services and marketing

initiatives that are enabled by the billing system. The

Report profiles which billers lead in this important

category and discusses the impact of new initiatives

such as life style and enterprise marketing.

- Unified Billing & Product

Catalogs. Consolidating product information

in a single repository is a boon to large carriers who

want to reuse their billing assets and promotions across

regions, business units, and technologies. Here, the

Study examines state-of-the-art and shows what benefits

unified catalogs will bring and the challenges catalogs

pose to vendors and carriers.

- Network Equipment Providers

vs. Software Billers. In the wireless market,

software vendors selling real-time billing solutions

captured an early lead in on-line convergent software.

However, the study shows how vendors such as Huawei and

Nokia Siemens Networks aim to reverse the tables on

their competitors.

- Specialty Markets.

Which markets offer the greatest potential for growth?

Large incumbent carriers, emerging carriers,

multi-operator carriers, or MVNOs? The Report show in

which markets billing vendors are succeeding and the clever

solutions they offer to give them an edge in niche

markets.

- The Rising Importance of

Interconnect Billing. The global expansion of

telecom has been a boon to interconnect traffic. Now,

carriers are investing in interconnect billing and

full-blown “interconnect management systems” that

monitor contracts, track fast-moving prices, and do

settlements. Here the Report provides details on the

innovative Telarix interconnect and Amdocs content

partner management systems.

- Product Software vs. Custom

Services. The dark black lines that separate

software and services have grayed. On the one hand are

product companies like Oracle who offer a rich suite of

pre-integrated apps integrated by the likes of

Accenture, Tech Mahindra, and Capgemini. Conversely,

companies like Amdocs and Comarch are succeeding by

self-integrating their solutions. Which strategy will

win long term – or can both safely approaches peacefully

coexist? The Report tackles this and related

issues.

TRI’s study not only sorts through the key billing

trends and over 20 billing players, the intelligence can

also help you avoid making bad decisions: investing in the

wrong kind of billing solution, for example -- or if you’re

a vendor -- entering a market segment that’s either too

competitive or too specialized to attract sufficient

customers.

The Report will help you discover:

• What are the most important market priorities?

• Which operator

success strategies can you adopt at your

own telecom organization?

• Which vendors have industry

market share and are leading

in specific niches?

• Which Billing/Charging players should be your

partners?

• What Billing industry trends can your company capitalize on?

Please scan the table of contents below. You'll see why

this report delivers the tactical and strategic information

you need to understand where the telecom billing market is

headed.

To access this market intelligence today, contact Dan

Baker at TRI's offices at 570-620-2320.

Sincerely,

Dan Baker

Research Director, TRI

The

Telecom Billing & Charging Market

Table

of Contents

A. Executive Summary (2 pages)

B. Industry Trends Perspective (2 pages)

Stocking the Data Services Candy Store

The Convergence of Postpaid and Prepaid

Network Technology Uncertainty & Retooling

The Rise of Virtual Network Operators.

C. Billing's Functions (2 pages)

Pricing Management, Customer Balance Management,

Interconnect Settlements & Partner Management, Service

Authorization, Rating, Discounting and Promotions, Billing

Cycle Management, Financial Management, Payments and

Collections, Revenue Assurance, Direct Marketing &

Merchandising

D. Billing Market Drivers (2 pages)

System Consolidation After Merger

Legacy Billing Consolidation

Fixed Mobile Convergence

Subscriber Controls over Costs and Content Access

Dual-Use Mobile Handsets

Real-Time Market Share Threats in Mobile

Lower Cost of Ownership

Competing on Better Capability Rather than Lower Prices

E. Real-time and Convergent Charging (5 pages)

Traditional IN-based Pre-Paid Platforms

Why IN-Prepaid is Still Strong in Emerging Markets: Nokia

Siemens

The Challenge of Migrating Pre-Paid to Convergence Charging

Why True Real-Time Capability is Vital

OnBoard vs. OffBoard Revenue Management: Convergys

Where Real-time Charging May Be Better than Recurring

Charges

Mixing Postpaid Wireless and Realtime Capabilities

The “Advanced Pay” Innovation of InfoDirections

Postpaid Collections in Wireless

F. The Merchandising & Direct Marketing Role of

Billing (5 pages)

Billing as Merchandising, not just Accounting System

Friends & Family Promotions and Balance Top Ups: Redknee

How Comverse Boosts the Revenue of its Clients

Amazon-Style: Thinking Like a Retailer

Offering Real-time Buying Opportunities

The Role of Subscriber Profile in Contextual Marketing

Customer Life Cycle Management

G. Lifestyle & Marketing Packages (4 pages)

Lifestyle Marketing at VimpelCom

Innovative Marketing Packages for Vodafone CZ: SITRONICS TS

The Complexity of a Multi-Operator Billing Solution: LHS

Managing the Complex Service Life Cycle of Subscribers

H. Monetary Systems for Emerging Markets (1 page)

The Special Monetary Needs of Emerging Carriers

Mom and Pop Retailers in Eastern Europe: Kabira

The Success of Voucher-less Top Ups in South America: Orga

Systems

I. Interconnect Billing Systems (7 pages)

The Interconnect Driver: Telecom Deregulation

International Voice Call Terminations

How Interconnect Deals Evolve to Become More Complex to

Manage: Intec

Telarix: Developing an Interconnect “Trading Platform”

The Interconnect Trading and Billing Platform

Revenue & Margin Assurance Virtues of Real-time Interconnect

Data

The Complexity of a Multi-Operator Billing Solution

Interconnect Crisis: Growth, Converged Networks & Compressed

Margins

Architecture of an Interconnect Billing System

J. Content Services Partner Management (2 pages)

The Rise of Content Services

The Evolution in Types of Digital Commerce

A Profile of Amdocs’ Digital Commerce & Billing Solution:

QPass

The Sales, Hosting and Billing of Digital Content

Content Delivery Options

K. The Unified Billing Platform & Product Catalog

(4 pages)

Billing and Rapidly Growing Product Line Crisis

The Enterprise Product Catalog for Large Carriers

The Billing Product Catalog at T-Mobile

The Architecture of the Amdocs Product Catalog

What the Future May Hold for Product Catalogs

The Attraction of Unified Billing Systems

The Risk that Product Catalogs and Unified Billing Brings to

Software

L. The MVNO Billing Opportunity (2 pages)

Capitalizing on Individual Customer Hot Buttons: the MVNO

Why MVNOs are Ramping up in Europe: The Auchan Group &

Comarch

MVNOs: A Mixture of Success and Failure in the U.S. Market

Wholesale Carrier Attitudes towards MVNOs

Will we see Business and Corporate MVNOs?

M. Software, Services & B/OSS Integration (5

pages)

Custom vs. Product Debates

Software and Integration Services Under One Roof: The Amdocs

Approach

Oracle’s Gambit: Enterprise Applications in Communications

Billing & Customer Care Expertise Leads to Consulting at

Convergys

Nokia Siemens Networks Touts OSS Integration with Billing

N. Billing Consolidation at AT&T Long Distance (5

pages)

Billing Systems Integration Problems

Reconciling Different Billing Software Development Cycles

AT&T Billing Systems Landscape

Consolidation via the “Concept of One”

Concept of Zero

Sarbanes-Oxley

The Database of Record

The Common Customer Identifier System

Leveraging a Service Oriented Architecture (SOA)

O. Mergers & Acquisitions (2 page)

P. Market Opportunities & Threats (5 pages)

1. Wireless Lifestyle

2. Triple Play and Wireline VoIP Markets

3. Emerging Markets Where Billing will Prosper

4. The Large Carrier Market

5. The Market for MVNO Billing

6. Risks that Product Catalogs and Unified Billing Bring

7. Semantic Integration Middleware

Q. Carrier Recommendations (4 pages)

Selecting a Billing/Charging System

Billing Convergence

Network Evolution

Enterprises and Cellular Costs

R. Vendor Recommendations (2 pages)

The Virtues of System Modularity

Porting to Low Cost Hardware

Billing Portals and Customer Support Chat

Tap into Interactive Marketing Expertise from Outside

Telecom

Value Driven Policies in Billing

S. Market Segmentation & Forecasts (8 pages)

How TRI Develops its Market Segmentations

Market Growth Forecast

OEM vs. Service Provider

Distribution Channels

Geographic Region

Service Provider Type

Service Provider Size

Delivery Method

Billing Applications

T. Billing Definitions (5 pages)

U. Case Studies (20 pages)

1. BT Global Services Billing Consolidation

2. Turkcell Affinity Marketing & Billing Innovations

3. Hybrid Charging/Billing Platform at Telkomsel in

Indonesia

4. Vodafone Australia Convergent Prepaid/Postpaid Charging

for Data Services

5. Boost Mobile, Prepaid Branded Billing at Sprint Nextel

Market

Segments & Forecasts

TRI has also sized and forecasted the worldwide

market for the billing software market in this

report. Our forecast model is based on several

parameters: TRI's historical tracking of the OSS/BSS

market; TRI’s forecast of Next Generation Network

(NGN) services growth; discussions with carrier experts; and

interviews with software and consulting vendors.

TRI's principal B/OSS analyst, Dan Baker, has been

tracking hte

The report provides 2007 base revenue and 2008 to 2012

forecasts for the global market in the following segments:

Overall Market Revenues

- Corporate, Telecom Industry & OSS/BSS Revenues

Business type

- OEM software, Telecoms software, Consulting/SI services

Channels of Distribution

- Direct, Indirect

Service Provider Type

- Circuit wireline, Broadband, Wireless, Cable/DBS, Virtual

Network Operator/Non-Facilities Operator, Other

Size of Carrier

- Tier 1 (>$10 bill. revenue), Tier 2 ($250 mill. to

$10 bill.), Tier 3 (<$250 million)

Geographic Region

- North America, EMEA, Asia Pacific, Latin America

Software Delivery Method

- Software License, Prof. Services, Service

bureau/Hosted

OSS/BSS Application Revenues of Billing Vendors

Billing Applications

- Billing, off-line/batch, Interconnect billing,

IN-based Prepaid, Charging, on-line/realtime, Mediation

Vendor

Profiles & SWOT Analysis

TRI's vendor profiles section delivers a detailed

analytical

snapshot of the leading billing companies. Twenty-two of the leading software vendors and network equipment

providers are profiled in the report as follows:

Each of the profiles are between 8 and 13 pages in

length (except for the Cellution profile which is 4-pages)

and are presented in the following sections:

1. Company Specifications and Web Links

This upfront backgrounder information in each profile is

organized in the same format for easy cross-reference in

other profiles.

Here you'll find basic company data organized for

fast retrieval and web access such as:

- Corporate backgrounder

- Overall OSS/BSS business

- Significant investors and stock market reference for

public firms

- Significant customers

- Major vendor partnerships

- Major worldwide locations

- Summaries of key products in the billing market

-

Number of employees

2. Company Revenue Breakdowns

In this section, we provide an estimate of each company's

individual revenue breakdown in the billing market.

The numbers are gathered from public documents, conversations

with people at the companies themselves, and TRI's

experience tracking the billing market since 1994.

Many companies provided guidance on their own numbers.

Here are the segments we breakdown for each company:

- Overall Market Revenues

- Corporate, Telecom Industry & OSS/BSS Revenues

- Business type

- OEM software, Telecoms software, Consulting/SI services

- Channels of Distribution

- Direct, Indirect

- Service Provider Type

- Circuit wireline, Broadband, Wireless, Cable/DBS, Virtual

Network Operator/Non-Facilities Operator, Other

- Size of Carrier

- Tier 1 (>$10 bill. revenue), Tier 2 ($250 mill. to

$10 bill.), Tier 3 (<$250 million)

- Geographic Region

- North America, EMEA, Asia Pacific, Latin America

- Software Delivery Method

- Software License, Prof. Services, Service

bureau/Hosted

- Billing Applications

- Billing, off-line/batch, Interconnect billing,

IN-prepaid and Charging, and Mediation

This calendar year 2007 data is made further accessible

in a a database

program (delivered as free software with the text report)

that allows you to create instant tables and graphs,

compare various company market shares across these segments,

and produce a variety of reports in Excel format.

Prior year (2006 and 2005) data is also provided on billing

and other OSS/BSS market for historical analysis.

3. TRI Discussion of Company and SWOT Analysis

You'll no doubt find this section the most valuable

because it's here where each company's billing business is

put into context. In this section, TRI

gets into a

free wheeling discussion on company success

stories, challenges, and significant product developments.

In this discussion, we meander quite a bit on the significance of

company histories, new product/marketing initiatives,

telecom customers, geographic markets, and competitive

forces.

The section concludes with a company Strengths,

Weaknesses, Opportunities, and Threats (SWOT) analysis -- a

candid TRI opinion on where each vendor stands

against its competitors and the suitability of its products

and services for the billing market.

TRI's competitive analysis draws from significant

research such as attending billing conferences and speaking with

billing experts at telecoms. We also held 30-minute or

longer conversations with executives at 21 of the 22 billing

companies we profiled for this report.

Getting so many billing vendors to participate was an

invaluable aid to the research effort because TRI got

to hear how each company interpreted its role in the

marketplace. In turn, TRI could challenge each

company on competitive issues, evaluate trends, and gain

insights on the company's strategy.

When TRI finished its profiles, it also gave each

company a chance to check the profile for accuracy and

comment on TRI's analysis.

In all, we think our research methodology meets the twin

goals of: maximizing competitive insights; and

maintaining a relationship of trust with the sources of this

valuable information.

* * * * *

About

TRI’s

B/OSS Market Research Reports

TRI’s B/OSS market research studies are designed to help telecoms and OSS/BSS vendors track

market innovation in the sector.

Each of our reports delivers a fully

organized body of knowledge and analysis across three

interfaces:

- Complete Microsoft

Word text of Report and Vendor Profiles.

Forecasts are delivered in MS Excel;

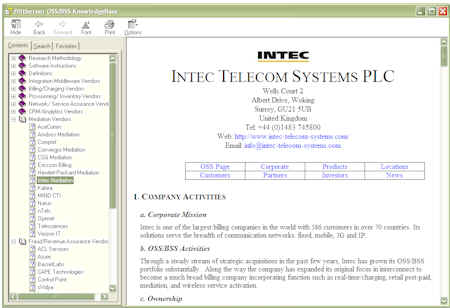

- A Compiled HTML file

for your desktop PC that allows searching the text and

visuals of our analysis modules, case studies, and

vendor profiles; and,

- A Software Application

(written in Microsoft Visual Foxpro) with market

segmentation and forecast data that you use to view

customized data tables, graphs, vendor comparisons, and

print documents. Note: all data and forecast

tables are also provided in Microsoft Excel and

comma delimited files can be created too.

Below are some sample screens:

Compare

vendor market strength in grids. . .

View,

modify, and print our estimates of company financials. . .

View

market share graphs in international currencies. . .

Report and Vendor

profiles delivered in a compiled HTML report. . .

Technology Research Institute

4-25 Rocky Mountain Drive North

Effort of the Poconos, PA 18330

Tel: 570-620-2320

|